The budget – or a beggar’s dilemma

Same sob-story – different year

“Dar’s ministry, having understood that Pakistan cannot meet the conditions of the IMF regarding employing tough tax and other reforms, has knocked on Beijing’s door, which is willing to give Islamabad loans and bailouts but with conditions that perhaps doesn’t impact Pakistan’s fiscal deficit in the short run.”

The economic survey that was released by the finance ministry ahead of the final budget of the current government, heading towards the next general elections, has been heralded as a remarkable accomplishment.

The country’s finance minister seemed jubilant when he quoted the fiscal year’s growth rate at 5.3%. The government has cited the growth rate as the highest achieved in at least last nine years. If one is to closely follow the indicators mentioned in the economic survey, it becomes evident that the numbers and performance indicators remain similar as those which were presented during the last year. However, the promises made by the government last year have been presented with the mere twist of facts, figures and by quoting performance in inflated terms.

Let’s decipher some of the indicators.

The government has claimed that the overall inflation rate was contained to 4.09%. However, the ministry has not clarified the source and basis of this suggestion: what factors were taken into account while arriving at this number? How can the government with the population figures that are based on a 20 years old census can accurately claim any statistics regarding the fall or increase in the country’s inflations rate? If one is to assume that inflation rate has not increased further, as the government claims, that means inflation continues to remain as high as it was during the previous year.

The finance minister, Ishaq Dar, has maintained that Pakistan’s economy has surpassed $300 billion. Dar has failed from explaining that what percentage of this economy is based on borrowed money and loan? Moreover, if the government’s optimism is to be taken as an indicator of growth than the ruling party needs to clarify that how many investments in this regard, and growth was generated by the private investors, small and big, which are hardly a result of the government’s efforts. A large sum of this number, that the government claims were added during the last fiscal year, has come due to the foreign investments whose nature remains beyond scrutiny, for the government has clearly shown reluctance toward making public any of its dealings, primarily with China, that happens to the newest addition to Pakistan’s loan ridden economy.

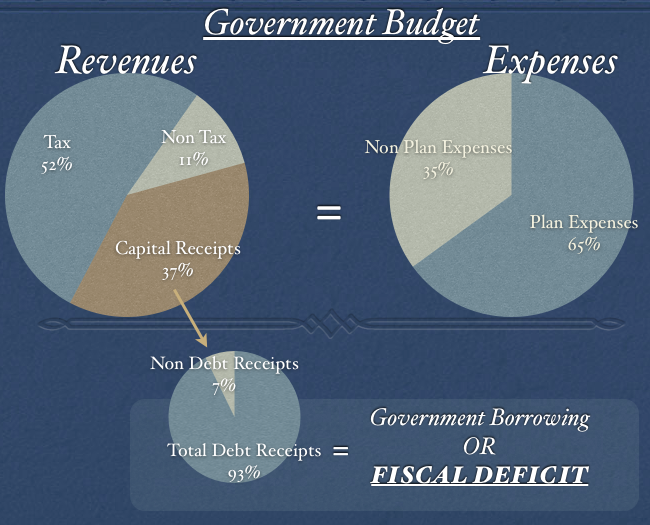

One of the most interesting aspects of the economic survey was the government’s claim that the fiscal deficit of Pakistan has registered a decrease, from 4.8 to 4.2 percent. While the federal minister quoted cherry picked facts to support his government’s claims of having secured a decrease in the country’s fiscal deficit, the economic realities on the ground point an alternative story: Pakistan today is more burdened with foreign loans and borrowed money than any time in Pakistan’s past history. For instance, the released economic survey doesn’t comprehensively mentions whether the investments and loans coming from China are part of the calculations upon which the government has based its claims of having decreased Pakistan’s fiscal deficit?

There are two major reasons that defy Dar’s claims regarding the decrease of the country’s fiscal deficit. First, Dar’s claim that Pakistan doesn’t need any more loans from the IMF comes in the wake of Pakistan’s growing economic reliance on Chinese loans. Put it in this way: Dar’s ministry, having understood that Pakistan cannot meet the conditions of the IMF regarding employing tough tax and other reforms, the former has knocked on Beijing’s door, which is willing to give Islamabad loans and bailouts but with conditions that perhaps doesn’t impact Pakistan’s fiscal deficit in the short run. A few weeks ago, China gave Pakistan more than 1 billion dollars in emergency loans to rescue the country from an impending currency crisis. The crisis has aggravated due to the rising imbalance in the country’s imports and exports. Recently, the State Bank of Pakistan released a report that noted that Pakistan’s net reserves have dropped to $17.1 billion in February from $18.9 billion in October 2016 and $25 billion several years ago. Another report recently claimed that “Pakistan is entitled to pay China up to $90 billion in three decades for the $50 billion worth of loan and investment portfolio Beijing rendered to the country.”

Second, apparently, the government at the moment is not considering Chinese loans as part of its fiscal deficit scheme which as the recently released report by Dawn claimed, would be returned back in the form of giving China the control of significant chunks of Pakistan’s domestic economy and industry through the China Pakistan Economic Corridor (CPEC) projects. However, Dar, on the other hand continues to harp that Pakistan doesn’t need any loans from the IMF, for the country’s economy is rapidly gaining independence. Dar’s claims pose the picture of a bagger’s dilemma where one has to choose between an expansive but pragmatic (IMF) and charming but unviable (China) donor.

Moreover, according to the economic survey and the newly presented budget, Pakistan’s tax collections have increased more than 70 percent in comparison to the previous year. However, the minister of finance has not elaborated that what percentage of these collections were made from the country’s elite class that controls more than half of Pakistan’s economy and continues to defy any regulations that bind them with fair and appropriate tax payments.

It’s unfortunate that the government continues to manipulate facts to showcase a rosy picture of Pakistan’s economy and growth rate which is far-fetched and unrealistic.