Pakistan’s nominal per capita income rose 16.9 percent to $1,254 in 2010-11 from $1,073 in 2009-2010, according to the

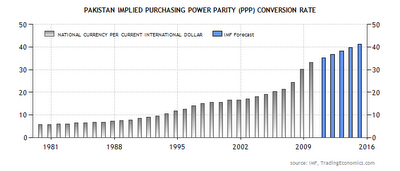

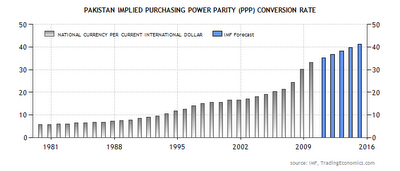

Economic Survey of Pakistan. Using the IMF’s

purchasing power parity exchange rate of Rs. 34 to a US dollar (versus official exchange rate of Rs. 85 to a US dollar), Pakistan’s per capita income in terms of purchasing power parity works out to $3,135.00.

Per Capita PPP GDP

Although Pakistan’s per capita GDP rose by only 0.7% in real terms, the much higher 16.9% nominal per capita income increase reflects a combination of the nation’s double-digit inflation rate and the the rupee’s stable exchange rate with the US dollar which has been losing ground to most major world currencies in 2010-2011.

Similar to Pakistan’s nominal growth, at least a part of India’s nominal growth in per capita gdp and income is also driven by rising domesticinflation of over 10% and appreciating Indian rupee (5.5% from 48.32 in 2009 to 45.65 in 2010) from strong hot money inflows from the Fed’s quantitative easing in the United States and elsewhere. India’s FDI hasdeclined by a third from $34.6 billion in 2009 to $23.7 billion in 2010. Its current account deficit is being increasingly funded by significant short-term capital inflows (FII up 66% from $17.4 billion in 2009 to $29 billion in 2010) rather than more durable foreign direct investment (FDI). This alarming trend of declining FDI and surging FII in India has continued into 2010-2011.

The idea of PPP or purchasing power parity is quite simple. A US dollar can be exchanged today for about 85 Pakistani rupees. But with Rs 85 you can buy more goods and services in Pakistan than one US dollar can buy in the United States. So Pakistan’s GDP expressed in dollars at current exchange rates is about 40% of what it is when adjusted for PPP. The current ratio for both Indian and Pakistani GDP conversion from nominal US dollars to PPP dollars is about 2.5, calculated as follows:

Country……Official Rate….Purchasing Power…..Ratio

India………..INR 45……………..INR 18……….2.5

Pakistan…….PKR 85…………….PKR 34……….2.5

Looking at the increase in per capita income alone is quite misleading in judging the health of Pakistan’s economy. Other indicators, such as real GDP growth and investments, show that the state of the economy is very poor. The nation’s GDP grew only 2.4% in real terms in 2010-2011. Domestic investment dropped to a 40-year low of 13.4% of GDP, and foreign direct investment (FDI) declined by 29 percent to $1.232 billion during July-April 2010-11 from $1.725 million in the same period a year earlier.

In addition to improved security environment, Pakistan has an urgent need for serious economic reform, greater social justice and better governance. Unless the PPP government acts to improve this situation, no amount of foreign aid, external loans and other help will suffice. The first step in the process is for the ruling elite to lead by example by paying their fair share of taxes and adopting less extravagant personal lifestyles to get Pakistan’s fiscal house in order.

Courtesy:

Reference

Double Digit Gains in Pakistan’s Per Capita Income

Riaz Haq’s Comments

Riaz Haq said…

The PPP conversion factor changes every year for both India and Pakistan as the inflation erodes the buying power of currencies in South Asia.

For example, here is the history of the purchasing power dollar exchange rate for Indian and Pakistani rupees as calculated by the World Bank:

Year India Pakistan

2006 15 20

2007 15 21

2008 16 24

2009 17 29

http://data.worldbank.org/indicator/PA.NUS.PPP I have used Rs 34 to a US dollar for Pakistan in 2011 to convert to PPP from nominal in my post.

IMF PPP conversion estimates for India and Pakistan for 2010 are INR 18 and Pak Rs 34 to a US dollar in 2011.

JUNE 12, 2011 9:40 AM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Here’s a recent piece on FDI decline and FII upsurge in India:

In 2010-11, inbound FDI into India fell by as much as 28%, the second consecutive year of decline and the first such large decline since the opening up of the economy in 1991-92. As a result of this decline, the present level of $27 billion of FDI inflows is the lowest in four years.

A large part of the progress made in FDI inflows over the boom years has now been reversed, with flows down by almost 29% from their high in 2007-08. This trend, more than just being odd, is also worrying when seen in the context of the fact that the past four years cover the recessionary period as well.

—-

The decline in FDI in 2009-10 could be explained by the fact that it was a year when recessionary effects were visible in the global economy. All BRIC countries (Brazil, Russia, India and China) saw declines in FDI flows during that year.

According to the United Nations Conference on Trade & Development (Unctad), flows into China fell by over 12% and to Russia and Brazil by as much as 49% and 42% from the previous year.

However, a number of emerging markets have shown substantial recovery in 2010. The RBI pointed to Unctad figures to show that countries like China, Brazil, Mexico and Thailand had in 2010 shown a rebound in FDI of between 6-53 percent. Indonesia apparently showed a three-fold rise from the previous year.

In India itself, FII flows have been on the rise over the past two years on an annual basis, with only 2008-09 being a year of sharp outflows. In fact, the outflow of $15 billion was more than made up by inflows of $29 billion — their highest ever — in 2009-10. This level was largely maintained in 2010-11 as well, with a small increase.

Both these factors go on to show that the decline in FDI into India in 2010-11 is not the result of a weak global situation or investor risk-aversion. The causes really lie elsewhere.

———–

FDI flows showed a dismal performance in almost every month of the previous financial year, with May being the only exception. By the end of the third quarter, it became clear that FDI inflows would be nowhere close to what they were the year before.

The RBI highlighted this in its quarterly ‘Macroeconomic and Monetary Developments (MMD) study released in January 2011 and suggested some reasons for the trend as well.

According to the bank, the “major reason for the decline in inward FDI is reported to have been the environment-sensitive policies pursued, as manifested in the recent episodes in the mining sector, integrated township projects and construction of ports, which appear to have affected the investors’ sentiments.”

The Ministry of Environment had recently questioned the ecological viability of the Korean steel giant, Posco’s proposed plans in Orissa, which could be one of India’s biggest FDIs ever.

The MMD review further goes on to observe that there are other reasons for the decline as well, such as “persistent procedural delays, land acquisition issues and availability of quality infrastructure”.

Indeed, delays in decision-making are visible in sectors like defence and multi-brand retail, discussions on which have been long in the works. The Department of Industrial Policy and Promotion (DIPP) had floated a discussion paper on defence in May 2010 and on multi-brand retail in July 2010.

Feedback on these was received by parties interested in the sector, but a decision on allowing FDI into these sectors is still nowhere in sight.

—

This is corroborated by the numbers. Both telecom and real estate have seen an above-average decline in FDI flows during the year. While flows into telecom declined by 35% to $1.6 billion, the flows to housing and real estate declined by as much as 60% to $1.1 billion…

http://www.firstpost.com/business/hot-money-is-flowing-but-rest-of-india-story-has-gone-cold-21519.htmlJUNE 14, 2011 6:12 PM

Riaz Haq said…

Here’s a BBC report of how inflation is hurting Indians and Pakistanis:

Inflation is the price that ordinary Asians are paying for high growth rates.

For the less well-off, who spend their money on food and fuel, the story is even worse. The rise in their household expenses at the moment is usually higher than headline inflation rates.

According to the International Monetary Fund, last year consumer prices rose 13.2% in India, 11.7% in Pakistan and 9.2% in Vietnam. Other Asian nations coped better but the average for developing Asia was 6% – compared to a 1.6% average rise in prices in advanced economies.

The speed at which prices are shooting up means that unless people find ways to save and invest effectively, they in fact get much poorer – even if Asia is getting richer.

—

The world is jealous of Asia’s sky-high growth rates, but for ordinary people the price of success is corrosive inflation which could eat away their savings.

”From outside it looks good,” says Manasi Pawar. “We’re staying in a big house, paying so much in rent and our kids are going to great schools.”

Manasi, a qualified software worker in hi-tech Hyderabad in India, recently became a full-time mother. Her husband also works in the IT industry.

The couple epitomise the emergence of a well-to-do middle class in Asian countries – except there’s one significant snag.

”We were actually losing money,” says Manasi.

The couple recently woke up to the fact that inflation rates of nearly 9% meant that their savings were actually disappearing in front of their eyes.

”We were sitting on a bunch of cash but we didn’t know where to put it, and it’s important that we don’t let it lie there in the bank – because a bank doesn’t give an interest rate that even matches the inflation rate,” she says.

—-

The poorest people in society, who spend disproportionately more on food, are hit most savagely of all.

But there is a way to fight back against inflation: to save, and to put some of that money in a part of the economy that rises along with inflation.

For most people, that means investing in shares or equities. “The only way you can make money long-term is through an equity linked product,” says Ms Halan.

Money in the bank in India may only earn 3% or 4% – which in fact means you are losing money. But equity linked funds in this exploding economy have risen much faster, sometimes as high as 25%.

http://www.bbc.co.uk/news/business-13959235

Riaz Haq said…

Here’s a Nepal Monitor report on MPI poverty in South Asia:

Among the 104 countries, Nepal ranks 82 in the Multidimensional Poverty Index (MPI) by Oxford Poverty and Human Development Initiative (OPHI) with UNDP support. Sri Lanka (32) tops South Asia followed by Pakstan (70), Bangladesh (73), India (74) and Nepal.

UNDP’s Human Development Report for this year, to be published in late October, will be based on this new MPI method. The new method incorporates 10 indicators of poverty, and these are clustered under three dimensions— education (years of schooling and child enrolment), health (child mortality and nutrition), and standard of living (electricity, drinking water, sanitation, flooring, cooking fuel, and assets).

UNDP’s earlier reports measured poverty in terms of survival, access to knowledge and decent standard of living (overall economic provisioning).

The latest MPI is based on surveys conducted on various countries between 2000 to 2007. Nepal’s statistics are from 2006.

Nepal is better positioned than Pakistan and India in terms of years of schooling for children and enrolments. Pakistan had 32.50 percent and India had 23.99 percent deprivation in the educational dimension whereas Nepal had 21.32 percent deprivation. Sri Lanka (6.26) and Bangladesh (18.70) fared better than Nepal and other countries in the region.

In the health dimension Nepal is better than the other surveys countries in the region—Sri Lanka (35.40 percent), Pakistan (36.35), Bangladesh (34.68), and India (33.53).

In the living standard measure Nepal was better than Sri Lanka (58.34) or Bangladesh (46.81), but worse than Pakistan (31.14) or India (41.33).

For the surveyed year 2006, Nepal’s MPI value was 0.350, the highest in the region. The MPI value reflects the percentage of people who are MPI poor and the average intensity of their poverty. Nepal’s Incidence of Poverty was 64.7 percent and her Average Intensity Across the Poor was 54.0 percent.

Slovenia, Czech Republic, Belarus, Latvia, Kazakhstan, Georgia, Hungary, Bosnia and Herzegovina, Serbia, and Albania, respectively, are the countries ranking in the top ten on the index for 104 developing countries. The surveyed countries have a combined population of 5.2 billion, which comprise 78 percent of the human total. The study reveals that a third of population in all surveyed countries combined live in multidimensional poverty.

Half of the world’s poor, according to the MPI, live in South Asia (51 percent or 844 million people). India, in particular, has more MPI poor people in eight of her states alone (421 million in Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Orissa, Rajasthan, Uttar Pradesh, and West Bengal) than in the 26 poorest African countries combined (410 million). The overall figure for the entire of African developing countries is 28 percent (458 million).

http://www.nepalmonitor.com/2010/07/post_22.htmlJULY 19, 2011 7:39 PM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Here’s a Jan, 2011 NDTV-PTI report on India’s per capita income:

Per capita income of Indians grew by 14.5 per cent to Rs. 46,492 in 2009-10 from Rs. 40,605 in the year-ago period, as per the revised data released by the government on Monday.

The new per capita income figure estimates on current market prices is over Rs. 2,000 more than the previous estimate of Rs. 44,345 (one nominal US dollar equals INR 44.34909, and PPP USD equals INR 18) calculated by the Central Statistical Organisation (CSO).

Per capita income means earnings of each Indian if the national income is evenly divided among the country’s population at 117 crore.

However, the increase in per capita income was only about 6 per cent in 2009-10 if it is calculated on the prices of 2004-05 prices, which is a better way of comparison and broadly factors inflation.

Per capita income (at 2004-05 prices) stood at Rs. 33,731 in FY10 against Rs. 31,801 in the previous year, the latest data on national income said.

The size of the economy at current prices rose to Rs. 61,33,230 crore in the last fiscal, up 16.1 per cent over Rs. 52,82,086 crore in FY’09.

Based on 2004-05 prices, the Indian economy expanded by 8 per cent during the fiscal ended March 2010. This is higher than 6.8 per cent growth in fiscal 2008-09.

The country’s population increased to 117 crore at the end of March 2010, from 115.4 crore in fiscal 2008-09.

Read more at:

http://profit.ndtv.com/news/show/india-s-per-capita-income-rises-to-rs-46-492-138555?cpJULY 22, 2011 6:28 PM

Riaz Haq said…

India’s GDP likely to hit $2 trillion this year, reports Rediff:

India is poised to join the coveted club of economies whose national income, or gross domestic product, exceeds $2 trillion.

According to recently released data, India’s nominal GDP is expected to grow at 14 per cent in 2011-12, to reach Rs 90 lakh crore (Rs 90 trillion). At a dollar exchange rate of Rs 45, this works out to $2 trillion.

However, if inflation is assumed to be 7 per cent and the real growth rate is 9 per cent as projected, the growth rate of 14 per cent may actually understate nominal growth rate by 2 percentage points, which means India’s nominal GDP in dollar terms will actually exceed $2 trillion this fiscal!

India’s nominal GDP crossed the $1-trillion mark in 2007-08, which implies GDP has doubled in four years.

First, the magic number of $2 trillion is based on an exchange rate of $45 to the dollar. If the rupee were to depreciate, India’s nominal GDP would be lower for the same level of output.

Second, in celebrating the nominal as opposed to the real GDP, we may be losing sight of the contribution of inflation.

The difference between real and nominal GDP is inflation, and so for a given level of real GDP, the higher the inflation the more rapidly would nominal GDP increase. This is clearly an undesirable outcome for everybody.

——

Statistical convolutions aside, the health of the Indian economy needs a candid review, particularly in light of potential downsides that could derail the genuine progress the Indian economy has made over the past two decades.

The slowdown in virtually all sectors of the economy, barring a few select industries like ‘transport, logistics and communication’, which has been growing annually at 25 per cent, is indeed worrisome.

Growth in the agriculture sector continues to be dampened by under-investment, despite some increase during the past five years. This has resulted in the sector being caught in a classic low productivity trap.

Manufacturing too is spinning on its wheels, with annual growth rates stubbornly in the single digits. This reflects deeply embedded structural problems, which have been discussed in this space.

India’s economic growth continues to rely on the service sector growing at or around 10 per cent annually, which renders it vulnerable to global shocks.

The situation on the supply side also leaves a lot to be desired. This particularly applies to the tardy progress in the development of infrastructure and investment in human development, which is already holding India back.

http://www.rediff.com/business/slide-show/slide-show-1-budget-2011-india-set-to-become-a-2-trillion-dollar-economy/20110307.htmJULY 31, 2011 8:50 AM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Here’s a News International report on impact of US downgrade on Pakistan:

The ongoing economic crisis across the world after downgrade of the United States credit rating would have a positive impact on Pakistan’s economy as analysts said that the current account balance would stay in surplus and the electricity subsidy will automatically be contained.

The United States credit rating downgrade after enhancement of debt ceiling rattled the stock markets around the globe and majority of the equity markets have touched their lower locks. While major commodities, except gold, have also witnessed sharp decline in their prices after 2008.

“With the decline in oil prices globally, Pakistan’s current account balance is likely to stay in surplus and the electricity subsidy will automatically be contained,” according to a JS research report on Tuesday.

The report said that the growth is expected to rebound due to the bumper agriculture crops and inflation would tame further, whereas equity market will remain resilient compared to its regional peers due to lower foreign exposure.

“However, political instability and deteriorating law and order situation are the key risks to the economy,” it added.

Analysts said that the present global crisis is different to 2008. The crisis of 2007/08 was driven by excessive overheating of the global economy and resultantly commodity and real estate markets touched their peak levels.

In that crisis, Pakistan suffered as a result of higher global commodity prices and the government flawed domestic prices of providing huge subsidy.

“As a result, the twin deficits hit 16.3 percent of the GDP,” the JS report revealed, adding that this difficult scenario led to the International Monetary Fund (IMF) programme in order to bailout the economy from the brink of collapse.

However, the report said that in 2011/12 crisis Pakistan’s macros will be resilient and will benefit from the decline in the global commodity prices.

“Unlike 2008, Pakistan’s real interest rates are positive, real effective exchange rate is not overvalued and subsidies are largely contained,” it added.

About the United States austerity plan and its impact on Pakistan, experts believed that the United States is unlikely to reduce its spending towards the war on terror.

The American economy is going through its worst period in history, where Obama’s administration is left with very little fiscal space to finance its ballooning fiscal deficit that is around nine percent of the GDP.

The stimulus package of post-Lehman crisis has left the Federal Reserve Bank of America literally with no option either. To smooth the functions of the US Treasury, the lawmakers have agreed to provide additional $2.4 trillion to the debt ceiling, subject to deficit saving of approximately $1 trillion over the next decade.

This year the Americans are unlikely to reduce their spending as the austerity measures decided will be implemented from 2013 onwards, experts said.

The JS report said that the United States will continue to pay for counterinsurgency programme in Afghanistan even if it plans to pullout from Afghanistan by 2014.

On Pakistan’s front, the United States will definitely play the role of the devil’s advocate and delay the due payments or reduce the grant size, according to the report.

Overall, the presence of the United States in Afghanistan will keep the dollar flows continued into Pakistan directly or indirectly, the report said, adding that the United States rationalisation of budgets will have a bare minimum impact on Afghanistan and Pakistan.

http://www.thenews.com.pk/TodaysPrintDetail.aspx?ID=61883&Cat=3AUGUST 10, 2011 10:20 PM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Here’s an excerpt from Indian govt press release on per capita income in India for 2011:

The Minister of State (Independent Charge) for Statistics and Programme Implementation Shri Srikant Kumar Jena has said that the Per Capita Income at the national level, which was Rs. 24,143 in the year 2004-05, stands at Rs. 54,835 in the year 2010-11, showing an increase of more than 120%. The details of State/UT-wise per capita income (Net State Domestic Product at factor cost) at current prices, for the years 2004-05 to 2009-10, as compiled and provided by the Directorates of Economics & Statistics of the States, are given in the table at Annex.

http://pib.nic.in/newsite/PrintRelease.aspx The current ratio for both Indian and Pakistani GDP conversion from nominal US dollars to PPP dollars is about 2.5, calculated as follows:

Country……Official Rate….Purchasing Power…..Ratio

India…..INR 45….INR 18….2.5

Pakistan.PKR 85…PKR 34……….2.5

Using 18 INR to a PPP dollar, Indian PPP per capita income for 2011 works out to $ 3,046.

AUGUST 15, 2011 7:52 PM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Nominal per capita incomes in both India and Pakistan stand at just over $1200 a year, according to figures released in May and June of 2011 by the two governments. This translates to about $3100 per capita in terms of PPP (purchasing power parity). Using a more generous PPP correction factor of 2.9 for India as claimed by Economic Survey of India 2011 rather than the 2.5 estimated by IMF for both neighbors, the PPP GDP per capita for Indian and Pakistan work out to $3532 and $3135 respectively.

Nominal per capita income of Indians grew by 17.9 per cent to Rs 54,835, or $1218, in 2010-11 from Rs 46,492 in the year-ago period, according to the revised data released by the government in May, 2011 as reported by Indian media.

In June 2011, Economic Survey of Pakistan reported that the nominal per capita income of Pakistanis rose 16.9 percent to $1,254 in 2010-11, up from $1,073 in 2009-2010.

AUGUST 19, 2011 8:57 AM

http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>

Riaz Haq said…

Rising per capita income and a growing, young population spending more time online and at Western movies are helping build a mass market in Pakistan, according to Businessweek:

One way to take a city’s economic pulse is to check out where locals shop. In Karachi, Pakistan, shoppers are flocking to Port Grand, which opened in May. Built as a promenade by the historic harbor for almost $23 million, the center caters to Pakistanis eager to indulge themselves. This city of 20 million has seen more than 1,500 deaths from political and sectarian violence from January to August. At Port Grand the only hint of the turmoil is the presence of security details and surveillance cameras. “The whole world is going through a new security environment,” says Shahid Firoz, 61, Port Grand’s developer. “We have to be very conscious of security just as any other significant facility anywhere in the world needs to be.”

Young people stroll the promenade eating burgers and fries and browsing through 60 stores and stalls that sell everything from high fashion to silver bracelets to ice cream. Ornate benches dot a landscaped area around a 150-year-old banyan tree. “Port Grand is something fresh for the city, very aesthetically pleasing and unique,” says Yasmine Ibrahim, a 25-year-old Lebanese American who is helping set up a student affairs office at a new university in Karachi.

One-third of Pakistan’s 170 million people are under the age of 15, which means the leisure business will continue to grow, says Naveed Vakil, head of research at AKD Securities. Per capita income has grown to $1,254 a year in June from $1,073 three years ago.

The appetite for things American is strong despite the rise in tensions between the two allies. Hardee’s opened its first Karachi outlet in September: In the first few days customers waited for hours. It plans to open 10 more restaurants in Pakistan in the next two and a half years, says franchisee Imran Ahmed Khan. U.S. movies are attracting crowds to the recently opened Atrium Cinemas, which would not be out of place in suburban Chicago. Current features include The Adventures of Tintin and the latest Twilight Saga installment. Mission: Impossible—Ghost Protocol is coming soon. Operator Nadeem Mandviwalla says the cinema industry in Pakistan is growing 30 percent a year.

Exposure to Western lifestyles through cable television and the Internet is raising demand for these goods and services. Pakistan has 20 million Internet users, compared with 133,900 a decade ago, while 25 foreign channels, such as CNN (TWX) and BBC World News, are now available. And for many Pakistanis, reruns of the U.S. sitcom Everybody Loves Raymond are a regular treat.

The bottom line: With per capita income rising quickly, Pakistan is developing a mass market eager for Western goods.

Riaz Haq said…The PPP conversion factor changes every year for both India and Pakistan as the inflation erodes the buying power of currencies in South Asia.

For example, here is the history of the purchasing power dollar exchange rate for Indian and Pakistani rupees as calculated by the World Bank:

Year India Pakistan

2006 15 20

2007 15 21

2008 16 24

2009 17 29

http://data.worldbank.org/indicator/PA.NUS.PPP

I have used Rs 34 to a US dollar for Pakistan in 2011 to convert to PPP from nominal in my post.

IMF PPP conversion estimates for India and Pakistan for 2010 are INR 18 and Pak Rs 34 to a US dollar in 2011.Riaz Haq said…Here’s a recent piece on FDI decline and FII upsurge in India:

In 2010-11, inbound FDI into India fell by as much as 28%, the second consecutive year of decline and the first such large decline since the opening up of the economy in 1991-92. As a result of this decline, the present level of $27 billion of FDI inflows is the lowest in four years.

A large part of the progress made in FDI inflows over the boom years has now been reversed, with flows down by almost 29% from their high in 2007-08. This trend, more than just being odd, is also worrying when seen in the context of the fact that the past four years cover the recessionary period as well.

—-

The decline in FDI in 2009-10 could be explained by the fact that it was a year when recessionary effects were visible in the global economy. All BRIC countries (Brazil, Russia, India and China) saw declines in FDI flows during that year.

According to the United Nations Conference on Trade & Development (Unctad), flows into China fell by over 12% and to Russia and Brazil by as much as 49% and 42% from the previous year.

However, a number of emerging markets have shown substantial recovery in 2010. The RBI pointed to Unctad figures to show that countries like China, Brazil, Mexico and Thailand had in 2010 shown a rebound in FDI of between 6-53 percent. Indonesia apparently showed a three-fold rise from the previous year.

In India itself, FII flows have been on the rise over the past two years on an annual basis, with only 2008-09 being a year of sharp outflows. In fact, the outflow of $15 billion was more than made up by inflows of $29 billion — their highest ever — in 2009-10. This level was largely maintained in 2010-11 as well, with a small increase.

Both these factors go on to show that the decline in FDI into India in 2010-11 is not the result of a weak global situation or investor risk-aversion. The causes really lie elsewhere.

———–

FDI flows showed a dismal performance in almost every month of the previous financial year, with May being the only exception. By the end of the third quarter, it became clear that FDI inflows would be nowhere close to what they were the year before.

The RBI highlighted this in its quarterly ‘Macroeconomic and Monetary Developments (MMD) study released in January 2011 and suggested some reasons for the trend as well.

According to the bank, the “major reason for the decline in inward FDI is reported to have been the environment-sensitive policies pursued, as manifested in the recent episodes in the mining sector, integrated township projects and construction of ports, which appear to have affected the investors’ sentiments.”

The Ministry of Environment had recently questioned the ecological viability of the Korean steel giant, Posco’s proposed plans in Orissa, which could be one of India’s biggest FDIs ever.

The MMD review further goes on to observe that there are other reasons for the decline as well, such as “persistent procedural delays, land acquisition issues and availability of quality infrastructure”.

Indeed, delays in decision-making are visible in sectors like defence and multi-brand retail, discussions on which have been long in the works. The Department of Industrial Policy and Promotion (DIPP) had floated a discussion paper on defence in May 2010 and on multi-brand retail in July 2010.

Feedback on these was received by parties interested in the sector, but a decision on allowing FDI into these sectors is still nowhere in sight.

—

This is corroborated by the numbers. Both telecom and real estate have seen an above-average decline in FDI flows during the year. While flows into telecom declined by 35% to $1.6 billion, the flows to housing and real estate declined by as much as 60% to $1.1 billion…

http://www.firstpost.com/business/hot-money-is-flowing-but-rest-of-india-story-has-gone-cold-21519.htmlJUNE 14, 2011 6:12 PM <img src=”http://4.bp.blogspot.com/_dj7hueuj-class=”photo” alt=””>Riaz Haq said…Here’s a BBC report of how inflation is hurting Indians and Pakistanis:

Inflation is the price that ordinary Asians are paying for high growth rates.

For the less well-off, who spend their money on food and fuel, the story is even worse. The rise in their household expenses at the moment is usually higher than headline inflation rates.

According to the International Monetary Fund, last year consumer prices rose 13.2% in India, 11.7% in Pakistan and 9.2% in Vietnam. Other Asian nations coped better but the average for developing Asia was 6% – compared to a 1.6% average rise in prices in advanced economies.

The speed at which prices are shooting up means that unless people find ways to save and invest effectively, they in fact get much poorer – even if Asia is getting richer.

—

The world is jealous of Asia’s sky-high growth rates, but for ordinary people the price of success is corrosive inflation which could eat away their savings.

”From outside it looks good,” says Manasi Pawar. “We’re staying in a big house, paying so much in rent and our kids are going to great schools.”

Manasi, a qualified software worker in hi-tech Hyderabad in India, recently became a full-time mother. Her husband also works in the IT industry.

The couple epitomise the emergence of a well-to-do middle class in Asian countries – except there’s one significant snag.

”We were actually losing money,” says Manasi.

The couple recently woke up to the fact that inflation rates of nearly 9% meant that their savings were actually disappearing in front of their eyes.

”We were sitting on a bunch of cash but we didn’t know where to put it, and it’s important that we don’t let it lie there in the bank – because a bank doesn’t give an interest rate that even matches the inflation rate,” she says.

—-

The poorest people in society, who spend disproportionately more on food, are hit most savagely of all.

But there is a way to fight back against inflation: to save, and to put some of that money in a part of the economy that rises along with inflation.

For most people, that means investing in shares or equities. “The only way you can make money long-term is through an equity linked product,” says Ms Halan.

Money in the bank in India may only earn 3% or 4% – which in fact means you are losing money. But equity linked funds in this exploding economy have risen much faster, sometimes as high as 25%.

http://www.bbc.co.uk/news/business

Riaz Haq said…Here’s a Nepal Monitor report on MPI poverty in South Asia:

Among the 104 countries, Nepal ranks 82 in the Multidimensional Poverty Index (MPI) by Oxford Poverty and Human Development Initiative (OPHI) with UNDP support. Sri Lanka (32) tops South Asia followed by Pakstan (70), Bangladesh (73), India (74) and Nepal.

UNDP’s Human Development Report for this year, to be published in late October, will be based on this new MPI method. The new method incorporates 10 indicators of poverty, and these are clustered under three dimensions— education (years of schooling and child enrolment), health (child mortality and nutrition), and standard of living (electricity, drinking water, sanitation, flooring, cooking fuel, and assets).

UNDP’s earlier reports measured poverty in terms of survival, access to knowledge and decent standard of living (overall economic provisioning).

The latest MPI is based on surveys conducted on various countries between 2000 to 2007. Nepal’s statistics are from 2006.

Nepal is better positioned than Pakistan and India in terms of years of schooling for children and enrolments. Pakistan had 32.50 percent and India had 23.99 percent deprivation in the educational dimension whereas Nepal had 21.32 percent deprivation. Sri Lanka (6.26) and Bangladesh (18.70) fared better than Nepal and other countries in the region.

In the health dimension Nepal is better than the other surveys countries in the region—Sri Lanka (35.40 percent), Pakistan (36.35), Bangladesh (34.68), and India (33.53).

In the living standard measure Nepal was better than Sri Lanka (58.34) or Bangladesh (46.81), but worse than Pakistan (31.14) or India (41.33).

For the surveyed year 2006, Nepal’s MPI value was 0.350, the highest in the region. The MPI value reflects the percentage of people who are MPI poor and the average intensity of their poverty. Nepal’s Incidence of Poverty was 64.7 percent and her Average Intensity Across the Poor was 54.0 percent.

Slovenia, Czech Republic, Belarus, Latvia, Kazakhstan, Georgia, Hungary, Bosnia and Herzegovina, Serbia, and Albania, respectively, are the countries ranking in the top ten on the index for 104 developing countries. The surveyed countries have a combined population of 5.2 billion, which comprise 78 percent of the human total. The study reveals that a third of population in all surveyed countries combined live in multidimensional poverty.

Half of the world’s poor, according to the MPI, live in South Asia (51 percent or 844 million people). India, in particular, has more MPI poor people in eight of her states alone (421 million in Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Orissa, Rajasthan, Uttar Pradesh, and West Bengal) than in the 26 poorest African countries combined (410 million). The overall figure for the entire of African developing countries is 28 percent (458 million).

http://www.nepalmonitor.com/2010/07/post_22.htmlJULY 19, 2011 7:39 PM <img src=”http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>Riaz Haq said…Here’s a Jan, 2011 NDTV-PTI report on India’s per capita income:

Per capita income of Indians grew by 14.5 per cent to Rs. 46,492 in 2009-10 from Rs. 40,605 in the year-ago period, as per the revised data released by the government on Monday.

The new per capita income figure estimates on current market prices is over Rs. 2,000 more than the previous estimate of Rs. 44,345 (one nominal US dollar equals INR 44.34909, and PPP USD equals INR 18) calculated by the Central Statistical Organisation (CSO).

Per capita income means earnings of each Indian if the national income is evenly divided among the country’s population at 117 crore.

However, the increase in per capita income was only about 6 per cent in 2009-10 if it is calculated on the prices of 2004-05 prices, which is a better way of comparison and broadly factors inflation.

Per capita income (at 2004-05 prices) stood at Rs. 33,731 in FY10 against Rs. 31,801 in the previous year, the latest data on national income said.

The size of the economy at current prices rose to Rs. 61,33,230 crore in the last fiscal, up 16.1 per cent over Rs. 52,82,086 crore in FY’09.

Based on 2004-05 prices, the Indian economy expanded by 8 per cent during the fiscal ended March 2010. This is higher than 6.8 per cent growth in fiscal 2008-09.

The country’s population increased to 117 crore at the end of March 2010, from 115.4 crore in fiscal 2008-09.

Read more at: http://profit.ndtv.com/news/show/india-s-per-capita-income-rises-to-rs-46-492-138555?cpJULY 22, 2011 6:28 PM <img src=”http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>Riaz Haq said…India’s GDP likely to hit $2 trillion this year, reports Rediff:

India is poised to join the coveted club of economies whose national income, or gross domestic product, exceeds $2 trillion.

According to recently released data, India’s nominal GDP is expected to grow at 14 per cent in 2011-12, to reach Rs 90 lakh crore (Rs 90 trillion). At a dollar exchange rate of Rs 45, this works out to $2 trillion.

However, if inflation is assumed to be 7 per cent and the real growth rate is 9 per cent as projected, the growth rate of 14 per cent may actually understate nominal growth rate by 2 percentage points, which means India’s nominal GDP in dollar terms will actually exceed $2 trillion this fiscal!

India’s nominal GDP crossed the $1-trillion mark in 2007-08, which implies GDP has doubled in four years.

First, the magic number of $2 trillion is based on an exchange rate of $45 to the dollar. If the rupee were to depreciate, India’s nominal GDP would be lower for the same level of output.

Second, in celebrating the nominal as opposed to the real GDP, we may be losing sight of the contribution of inflation.

The difference between real and nominal GDP is inflation, and so for a given level of real GDP, the higher the inflation the more rapidly would nominal GDP increase. This is clearly an undesirable outcome for everybody.

——

Statistical convolutions aside, the health of the Indian economy needs a candid review, particularly in light of potential downsides that could derail the genuine progress the Indian economy has made over the past two decades.

The slowdown in virtually all sectors of the economy, barring a few select industries like ‘transport, logistics and communication’, which has been growing annually at 25 per cent, is indeed worrisome.

Growth in the agriculture sector continues to be dampened by under-investment, despite some increase during the past five years. This has resulted in the sector being caught in a classic low productivity trap.

Manufacturing too is spinning on its wheels, with annual growth rates stubbornly in the single digits. This reflects deeply embedded structural problems, which have been discussed in this space.

India’s economic growth continues to rely on the service sector growing at or around 10 per cent annually, which renders it vulnerable to global shocks.

The situation on the supply side also leaves a lot to be desired. This particularly applies to the tardy progress in the development of infrastructure and investment in human development, which is already holding India back.

http://www.rediff.com/business/slide-show/slide-show-1-budget-2011-india-set-to-become-a-2-trillion-dollar-economy/20110307.htmJULY 31, 2011 8:50 AM <img src=”http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>Riaz Haq said…Here’s a News International report on impact of US downgrade on Pakistan:

The ongoing economic crisis across the world after downgrade of the United States credit rating would have a positive impact on Pakistan’s economy as analysts said that the current account balance would stay in surplus and the electricity subsidy will automatically be contained.

The United States credit rating downgrade after enhancement of debt ceiling rattled the stock markets around the globe and majority of the equity markets have touched their lower locks. While major commodities, except gold, have also witnessed sharp decline in their prices after 2008.

“With the decline in oil prices globally, Pakistan’s current account balance is likely to stay in surplus and the electricity subsidy will automatically be contained,” according to a JS research report on Tuesday.

The report said that the growth is expected to rebound due to the bumper agriculture crops and inflation would tame further, whereas equity market will remain resilient compared to its regional peers due to lower foreign exposure.

“However, political instability and deteriorating law and order situation are the key risks to the economy,” it added.

Analysts said that the present global crisis is different to 2008. The crisis of 2007/08 was driven by excessive overheating of the global economy and resultantly commodity and real estate markets touched their peak levels.

In that crisis, Pakistan suffered as a result of higher global commodity prices and the government flawed domestic prices of providing huge subsidy.

“As a result, the twin deficits hit 16.3 percent of the GDP,” the JS report revealed, adding that this difficult scenario led to the International Monetary Fund (IMF) programme in order to bailout the economy from the brink of collapse.

However, the report said that in 2011/12 crisis Pakistan’s macros will be resilient and will benefit from the decline in the global commodity prices.

“Unlike 2008, Pakistan’s real interest rates are positive, real effective exchange rate is not overvalued and subsidies are largely contained,” it added.

About the United States austerity plan and its impact on Pakistan, experts believed that the United States is unlikely to reduce its spending towards the war on terror.

The American economy is going through its worst period in history, where Obama’s administration is left with very little fiscal space to finance its ballooning fiscal deficit that is around nine percent of the GDP.

The stimulus package of post-Lehman crisis has left the Federal Reserve Bank of America literally with no option either. To smooth the functions of the US Treasury, the lawmakers have agreed to provide additional $2.4 trillion to the debt ceiling, subject to deficit saving of approximately $1 trillion over the next decade.

This year the Americans are unlikely to reduce their spending as the austerity measures decided will be implemented from 2013 onwards, experts said.

The JS report said that the United States will continue to pay for counterinsurgency programme in Afghanistan even if it plans to pullout from Afghanistan by 2014.

On Pakistan’s front, the United States will definitely play the role of the devil’s advocate and delay the due payments or reduce the grant size, according to the report.

Overall, the presence of the United States in Afghanistan will keep the dollar flows continued into Pakistan directly or indirectly, the report said, adding that the United States rationalisation of budgets will have a bare minimum impact on Afghanistan and Pakistan.

http://www.thenews.com.pk/TodaysPrintDetail.aspx?ID=61883&Cat=3AUGUST 10, 2011 10:20 PM <img src=”http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>Riaz Haq said…Here’s an excerpt from Indian govt press release on per capita income in India for 2011:

The Minister of State (Independent Charge) for Statistics and Programme Implementation Shri Srikant Kumar Jena has said that the Per Capita Income at the national level, which was Rs. 24,143 in the year 2004-05, stands at Rs. 54,835 in the year 2010-11, showing an increase of more than 120%. The details of State/UT-wise per capita income (Net State Domestic Product at factor cost) at current prices, for the years 2004-05 to 2009-10, as compiled and provided by the Directorates of Economics & Statistics of the States, are given in the table at Annex.

http://pib.nic.in/newsite/PrintRelease.aspx

The current ratio for both Indian and Pakistani GDP conversion from nominal US dollars to PPP dollars is about 2.5, calculated as follows:

Country……Official Rate….Purchasing Power…..Ratio

India…..INR 45….INR 18….2.5

Pakistan.PKR 85…PKR 34……….2.5

Using 18 INR to a PPP dollar, Indian PPP per capita income for 2011 works out to $ 3,046.AUGUST 15, 2011 7:52 PM <img src=”http://4.bp.blogspot.com/_dj7hueuj-U0/SZ4fE28YCBI/AAAAAAAAA4Y/1uFweBSg82U/S45/riaz.jpg” width=”35″ height=”35″ class=”photo” alt=””>Riaz Haq said…Nominal per capita incomes in both India and Pakistan stand at just over $1200 a year, according to figures released in May and June of 2011 by the two governments. This translates to about $3100 per capita in terms of PPP (purchasing power parity). Using a more generous PPP correction factor of 2.9 for India as claimed by Economic Survey of India 2011 rather than the 2.5 estimated by IMF for both neighbors, the PPP GDP per capita for Indian and Pakistan work out to $3532 and $3135 respectively.

Nominal per capita income of Indians grew by 17.9 per cent to Rs 54,835, or $1218, in 2010-11 from Rs 46,492 in the year-ago period, according to the revised data released by the government in May, 2011 as reported by Indian media.

In June 2011, Economic Survey of Pakistan reported that the nominal per capita income of Pakistanis rose 16.9 percent to $1,254 in 2010-11, up from $1,073 in 2009-2010.Riaz Haq said…Rising per capita income and a growing, young population spending more time online and at Western movies are helping build a mass market in Pakistan, according to Businessweek:

One way to take a city’s economic pulse is to check out where locals shop. In Karachi, Pakistan, shoppers are flocking to Port Grand, which opened in May. Built as a promenade by the historic harbor for almost $23 million, the center caters to Pakistanis eager to indulge themselves. This city of 20 million has seen more than 1,500 deaths from political and sectarian violence from January to August. At Port Grand the only hint of the turmoil is the presence of security details and surveillance cameras. “The whole world is going through a new security environment,” says Shahid Firoz, 61, Port Grand’s developer. “We have to be very conscious of security just as any other significant facility anywhere in the world needs to be.”

Young people stroll the promenade eating burgers and fries and browsing through 60 stores and stalls that sell everything from high fashion to silver bracelets to ice cream. Ornate benches dot a landscaped area around a 150-year-old banyan tree. “Port Grand is something fresh for the city, very aesthetically pleasing and unique,” says Yasmine Ibrahim, a 25-year-old Lebanese American who is helping set up a student affairs office at a new university in Karachi.

One-third of Pakistan’s 170 million people are under the age of 15, which means the leisure business will continue to grow, says Naveed Vakil, head of research at AKD Securities. Per capita income has grown to $1,254 a year in June from $1,073 three years ago.

The appetite for things American is strong despite the rise in tensions between the two allies. Hardee’s opened its first Karachi outlet in September: In the first few days customers waited for hours. It plans to open 10 more restaurants in Pakistan in the next two and a half years, says franchisee Imran Ahmed Khan. U.S. movies are attracting crowds to the recently opened Atrium Cinemas, which would not be out of place in suburban Chicago. Current features include The Adventures of Tintin and the latest Twilight Saga installment. Mission: Impossible—Ghost Protocol is coming soon. Operator Nadeem Mandviwalla says the cinema industry in Pakistan is growing 30 percent a year.

Exposure to Western lifestyles through cable television and the Internet is raising demand for these goods and services. Pakistan has 20 million Internet users, compared with 133,900 a decade ago, while 25 foreign channels, such as CNN (TWX) and BBC World News, are now available. And for many Pakistanis, reruns of the U.S. sitcom Everybody Loves Raymond are a regular treat.

The bottom line: With per capita income rising quickly, Pakistan is developing a mass market eager for Western goods.